Tokio Marine’s intermediate decarbonisation target lacks ambition and impact

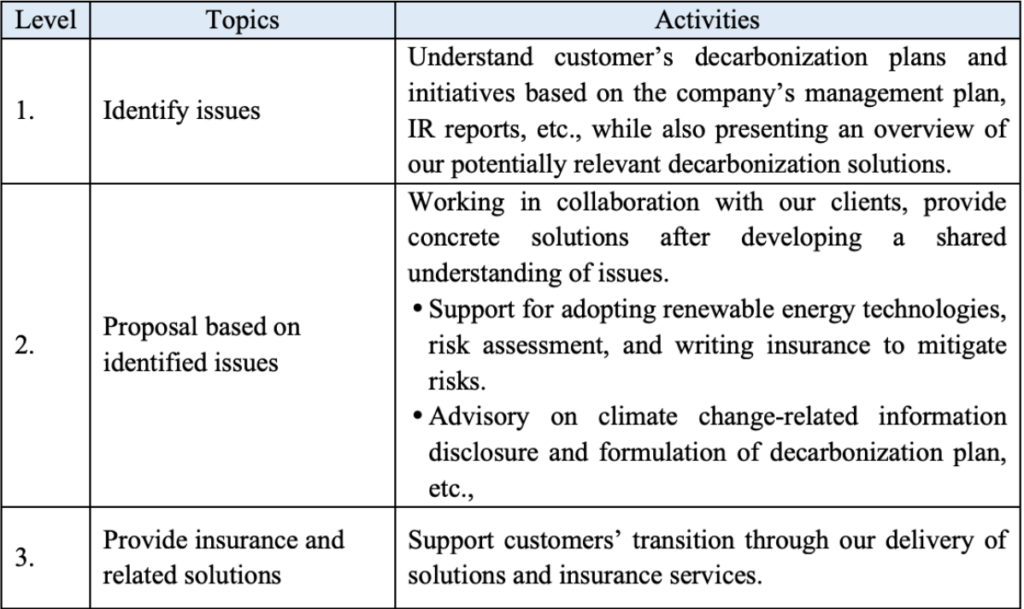

Tokyo, 2 October 2023 – On September 29th, Tokio Marine, Japan’s biggest property and casualty insurer and the 7th* biggest globally, announced its “Interim Target for 2030 for the Transition to a Decarbonized Society“. It has set an engagement target within its domestic subsidiary, Tokio Marine & Nichido Fire Insurance Co., Ltd. (TMNF), to engage with 200 major customers, which account for about 90% of greenhouse gas (GHG) emissions in its underwriting portfolio, and achieve level 2 or higher dialogue with more than 160 customers by 2030 (see chart below).

Tokio Marine has become the first Japanese insurer to set an intermediate target, however the commitment is extremely limited. Instead of following its global peers AXA and Allianz, and setting a GHG emissions reduction target in its underwriting portfolio, Tokio Marine has limited its ambition to engagement in a move that lacks impact and scope.

By comparison, AXA has committed to reduce the emissions of its major clients for its underwriting business by 30% by 2030, and Allianz has committed to cut the emissions from its underwriting business by 45% by 2030.

It is unclear how Tokio Marine will ensure its customer’s transition towards a maximum 1.5°C warming target, in line with the Paris Agreement, as it has not published a bold action plan in its engagement target in case of failure to cut GHG emissions. Another major loophole in the engagement target is that it is only limited to its domestic subsidiary, TMNF, and doesn’t include Tokio Marine Kiln, its major international fossil fuel underwriter.

Yuki Tanabe, Campaigner for Japan Center for a Sustainable Environment and Society (JACSES), said: “The effectiveness of Tokio Marine’s targets, based on engagement, is questionable as no meaningful counter measures are included should one of its customers fail to adopt sufficient decarbonisation plans. Tokio Marine should publish a clear 2030 target to reduce their insured GHG emission, as AXA and Allianz have done.”

On May 29th, Tokio Marine left the UN-convened Net Zero Insurance Alliance (NZIA), along with 2 other major Japanese insurers, MS&AD and SOMPO, under pressure from the fossil fuel lobby in the US. On exiting, Tokio Marine announced that it will continue to tackle climate change, however its weak 2030 interim targets raises questions about the company’s commitment.

As one of the world’s largest insurers, Tokio Marine must immediately set an intermediate GHG emissions reduction target and strengthen its engagement target and underwriting policy to exit from fossil fuels.

Peter Bosshard, Global Coordinator of Insure Our Future, said: “Insurance companies like Tokio Marine have engaged fossil fuel companies in a dialogue about the net zero transition for many years, without any tangible impact. The oil and gas industry has expanded its production, and major companies have walked back their net zero commitments. In the face of the climate emergency, Tokio Marine should stop playing games and cease insuring any new fossil fuel projects immediately.”

Engagement Target to Support the Transition to a Decarbonized Society (Tokio Marine)

* According to the data from Insuramore